Ripple: The Government's Favorite Trojan Horse Disguised as a Crypto Darling

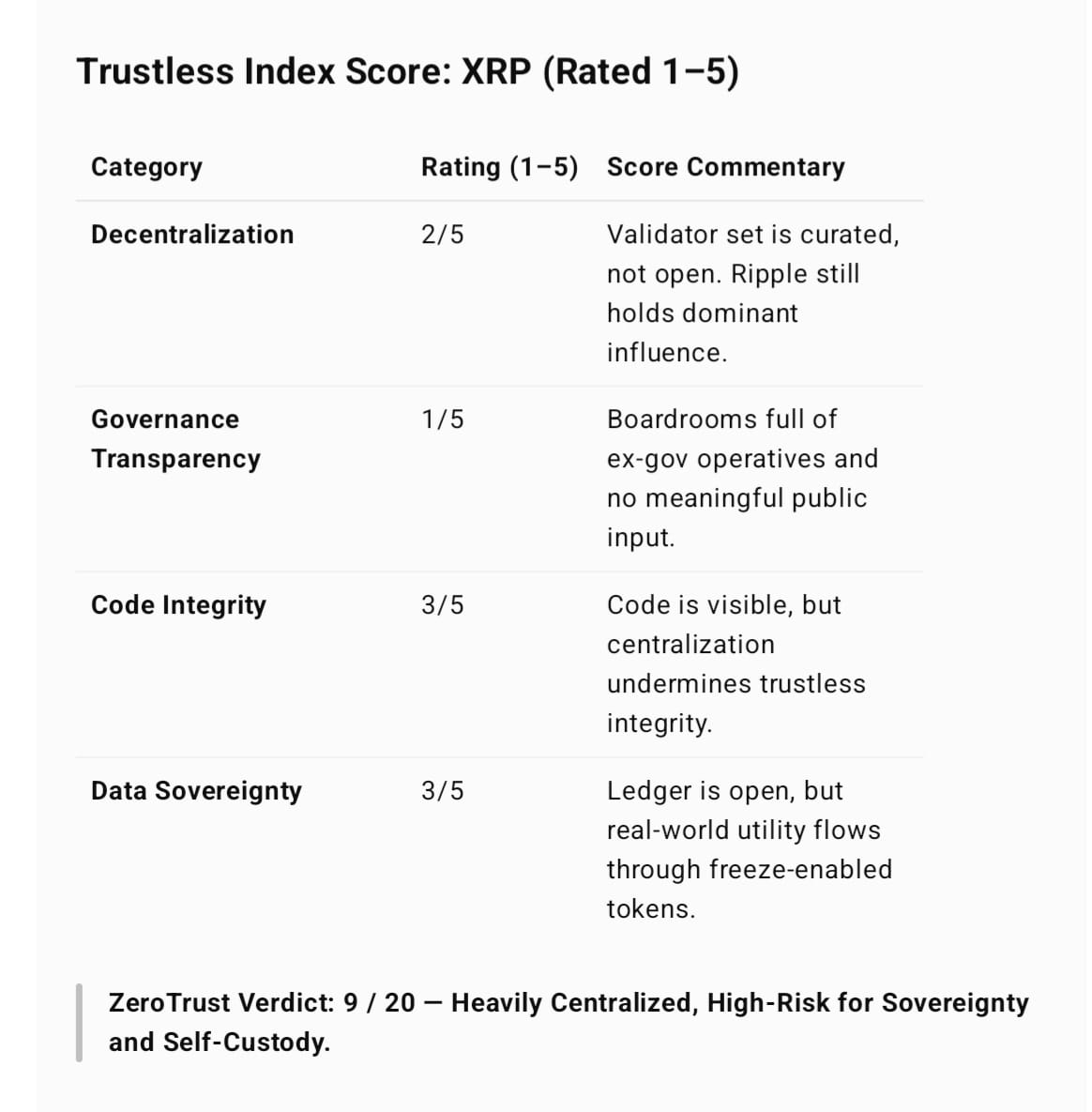

Let’s not forget the real kicker: Ripple’s technology is not decentralized. The validators are hand-picked. The code isn’t immutable. It’s an opt-in illusion of decentralization to placate retail investors while giving institutions the keys to the vault.

It’s time someone said it plainly: Ripple is not a crypto company. It’s a government agency in disguise.

Wrapped in sleek fintech packaging and camouflaged as private equity, Ripple is the textbook example of a public-private partnership engineered to condition the masses for full-spectrum financial surveillance—also known as CBDCs.

You want proof? Look at the executive team. The boardroom reads like a roll call of the deep state. Former U.S. Treasury officials, Federal Reserve connections, defense consultants, and intelligence agency affiliates all circle the Ripple nest. This isn’t a conspiracy—it’s corporate structure.

Follow the money, and the picture gets even clearer. Ripple’s funding traces directly back to VC firms whose portfolios are tied to DARPA, defense contractors, and intelligence-front tech unicorns. Ripple itself has poured tens of millions into political PACs and lobbying efforts, buying favor on both sides of the aisle—especially in the Trump-era swamp where the SEC case against Ripple conveniently fizzled out.

Let’s not forget the real kicker: Ripple’s technology is not decentralized. The validators are hand-picked. The code isn’t immutable. It’s an opt-in illusion of decentralization to placate retail investors while giving institutions the keys to the vault.

Oh, and that recent "win" against the SEC? Please. That wasn’t a victory for crypto—it was a legal smokescreen to clean XRP's image before it’s rebranded as the rails for programmable money. This is the beta test for CBDCs—and you’re investing in your own digital prison.

Let’s be honest: XRP is the Klaus Schwab coin with better marketing.

And if you need a case study in what happens when you hand over control to the wrong network, look no further than Ripple’s stablecoin RLUSD. Behind the soft branding lies the cold machinery of centralized authority: freeze functions, clawback clauses, and backdoor compliance mechanisms. This isn’t hypothetical—Ripple has made it very clear that RLUSD is fully compliant and fully controlled. If they don’t like what you’re doing with your money? They can stop it, seize it, reverse it, or burn it.

Sound like crypto to you? Or does it sound like the digital leash of the coming surveillance economy?

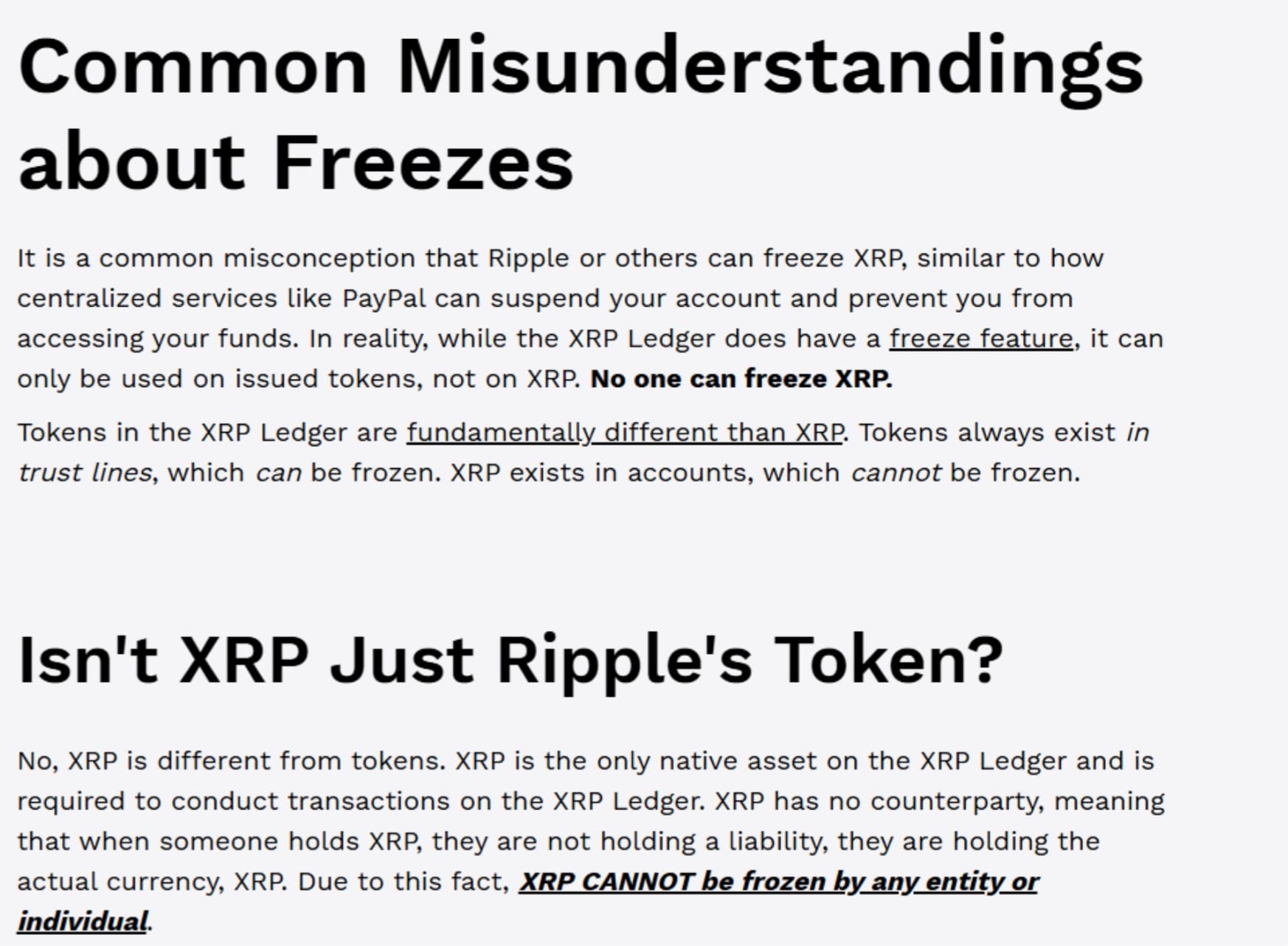

The Freeze Fallacy: The XRP Ledger's Sleight of Hand

In bold letters across Ripple-aligned media, you’ll see statements like:

“No one can freeze XRP.” “XRP exists in accounts, which cannot be frozen.”

Technically, that’s true. But here’s what they don’t want you to understand:

The freeze function on the XRP Ledger doesn’t apply to XRP itself—but it absolutely applies to everything else built on top of it:

▫️RLUSD (Ripple’s dollar stablecoin)

▫️Tokenized assets

▫️Liquidity pools

▫️Anything that relies on trust lines

And trust lines? Can be frozen.

So while your XRP might not be directly frozen, your ability to transact, bridge, or redeem absolutely can be.

This is like saying: “The engine still works.” While forgetting to mention: “The wheels are clamped and the keys are held by someone else.”

It gets worse.

Ripple’s freeze functions are issuer-controlled. That means if you’re holding RLUSD and Ripple (or its compliance partners) decides you’re flagged, they can:

▫️Freeze your tokens

▫️Reverse your transaction

▫️Burn your balance

And if you’re transacting through regulated partners or liquidity providers on the XRP Ledger? You’re already inside a compliance sandbox, not a trustless network.

As for the classic line:

“XRP isn’t Ripple’s token.”

That’s PR spin. Ripple built it. Ripple owns the lion’s share. Ripple markets it. Ripple shapes the ecosystem and now issues programmable stablecoins on top of it.

You can dress it up however you like—it’s central banking in drag.

The Final Truth

Ripple and XRP are the Trojan horse of this entire cycle—wrapped in promises of cross-border speed but hiding the teeth of centralized control. Investing in XRP isn’t just short-sighted. It’s dangerous. You’re endorsing the quiet rollout of financial totalitarianism.

And RLUSD? That’s your preview of what’s coming. A fully programmable, fully surveilled, state-approved stablecoin with a friendly face and a kill switch under the hood.

So go on—take the bait, cash in your conscience, and celebrate your little green candles. But don’t kid yourself. Every pump you cheer is another brick laid in the digital cage your children will one day inherit.

Welcome to ZeroTrust.

By Roman Wilder – PulseChain Nexus / ZeroTrust Division

🎯 Join PulseChain’s sharpest publication.