The GENIUS Act: A Regulatory Coup on Crypto Sovereignty

The irony? The Act claims to promote innovation — yet hands the keys of stablecoin innovation to Wall Street.

Well… there it is.

The GENIUS Act has just been signed into law.

Quietly, and without much noise outside our circles — but make no mistake, this one’s big. It doesn’t shout, it doesn’t slam the door… but it locks it.

And if you understand crypto — real crypto — you’ll know exactly what this means.

This isn’t just about stablecoins.

It’s about direction. It’s about control. It’s about drawing a line between what’s allowed… and what never will be.

Let’s get into it.

🏛️ A MONETARY RESET IN PLAIN SIGHT

Quietly, without the hype of a Bitcoin ETF or the panic of a bank collapse, the U.S. government just redrew the borders of crypto.

On July 18, 2025, the GENIUS Act — Guiding and Establishing National Innovation for U.S. Stablecoins — was signed into law.

And with that signature, stablecoins have been pulled into the regulatory machine.

If you issue one, you're either federally licensed… or outlawed.

But beneath the buzzwords of innovation and consumer protection lies a new financial doctrine — one that favors compliance over code, control over freedom, and banking rails over blockchain rails.

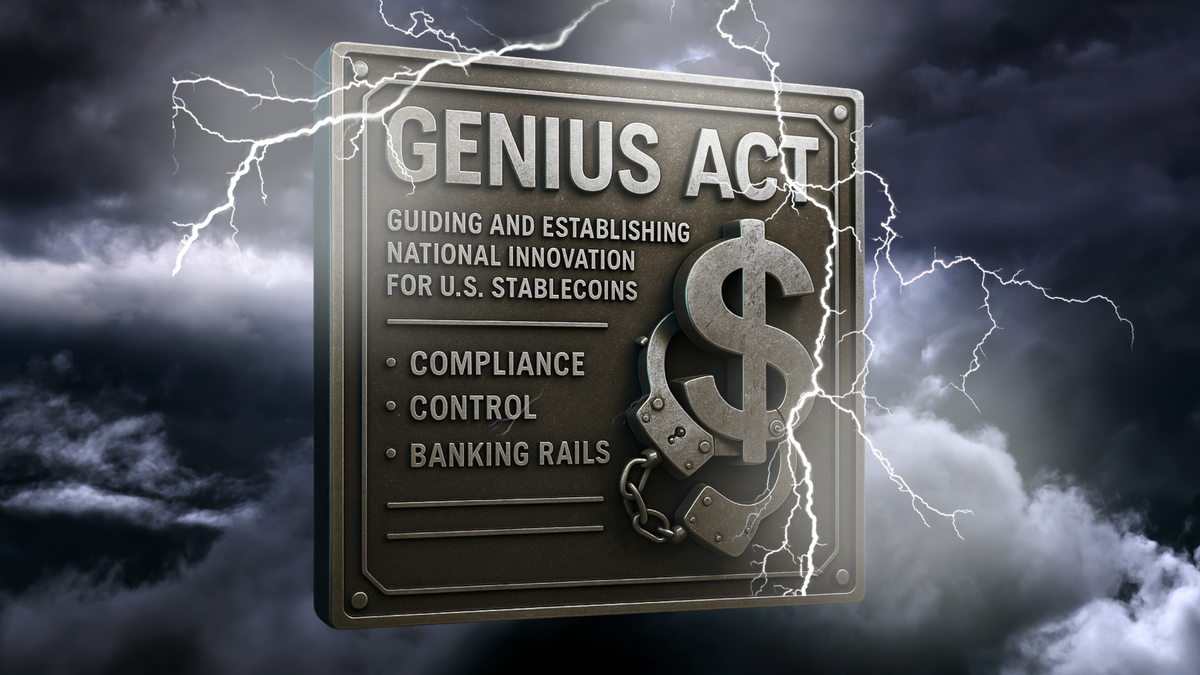

📜 THE ACT IN BRIEF: CONTROL THE CURRENCY, CONTROL THE FUTURE

- Only “permitted issuers” (licensed banks or approved non-banks) can create stablecoins

- All stablecoins must be fully reserved (cash, T-bills, short-term repo, etc.)

- Freeze and clawback compliance is mandatory

- No yield allowed — stablecoins must generate no return

- Public companies outside of finance face heavy restrictions unless approved by unanimous federal committee vote

Three years from now, all stablecoins marketed or offered in the U.S. must comply.

🏴 WHO IT PROTECTS — AND WHO IT SILENCES

Let’s not kid ourselves — this Act protects incumbents.

It cements the position of USDC, PayPal USD, and likely paves the runway for a JPM coin 2.0.

These entities:

- Hold the reserves

- Play nice with regulators

- Freeze when asked

- Track when told

But for projects rooted in true decentralization, the implications are chilling.

If you: - Don’t have a legal entity

- Can’t KYC your holders

- Don’t operate a redemption window

- Can’t comply with a lawful order…

...you’re no longer recognized. You’re illegal by omission.

🌀 WHERE DOES THIS LEAVE DEFI?

GENIUS doesn’t attack DeFi directly. It doesn’t need to. It simply removes its fuel.

- Lending becomes riskier

- Liquidity dries up

- Yield disappears

- Users flee to custodial safety

The irony? The Act claims to promote innovation — yet hands the keys of stablecoin innovation to Wall Street.

🌐 A GLOBAL TEMPLATE?

While GENIUS is a U.S. law, its extraterritorial bite is sharp.

It applies to any stablecoin offered to U.S. citizens, no matter where it originates.

- Europe may align through FATF and MiCA

- Asia will balance against CBDC pressures

- Exchanges worldwide will fall in line to avoid blacklists

It’s a regulatory template. One that others may copy — not because it’s right, but because it’s easy.

🍇 THE pDAI SCENARIO: IF THIS IS WHERE IT’S GOING...

Let’s stop pretending.

pDAI isn’t just some side-note anymore — it’s the main narrative.

Whether anyone’s ready to admit it or not, something’s clearly happening with it.

And while we’re still in the dark on the details — no devs, no official announcements, no front-end to poke at — the logic is undeniable:

If PulseChain is going to be a truly sovereign ecosystem…

It needs its own stable unit of account.

Not bridged. Not banked. Not blacklisted.

pDAI would be that unit.

So let’s theorize. Let’s assume we get a version of pDAI that:

- Pegs

- Survives

- Grows

- And becomes synthesized by PulseChain itself

❗ Implications for PulseChain

Economic Sovereignty: Liquidity becomes native. The chain becomes its own economy, no longer dependent on Ethereum-based stables.

Incentive Alignment: All activity — swaps, liquidity, lending — reinforces the PulseChain ecosystem instead of bleeding value out of it.

Censorship Resistance: No issuer. No blacklist. No court order can touch it. That’s decentralization in action.

Narrative Power: pDAI would be a symbol of defiance — a working stablecoin in a world of increasingly regulated shells.

Credibility in Crisis: When the next centralized stablecoin collapses, pDAI could stand as a safe haven — not because of trust, but because of math.

We’re not there yet. But we’re close enough to feel the tremor.

And if this plays out how it looks like it might — then PulseChain won’t just be a chain.

It’ll be an economic jurisdiction — with its own currency, its own rules, and its own future.

No middlemen.

No gatekeepers.

No masters.

— Martin Norton

✉️ Subscribe to Nexus+ for more fearless articles like this delivered directly to your inbox.

🗝️ Your subscription includes private access to our curated Telegram group — ideal for those navigating DeFi and PulseChain for the first time.