The Macro Clock Is Ticking — PulseChain’s Moment Is Written

The market loves immediacy. It thrives on the flash of a green candle, the sudden rally, the adrenaline of “this is it.”

But beneath that surface noise, something much larger is taking shape, something that will ultimately determine not only the path of traditional markets, but the very destiny of crypto itself.

Right now, the global money supply is quietly expanding again. You won’t see this plastered across headlines, but M2, the lifeblood of liquidity, is creeping upward. In China, stimulus has returned. In Europe, balance sheet expansion is happening in everything but name. Even in the U.S., where the Federal Reserve insists on its posture of restraint, the numbers tell another story. The tide is moving, slowly but undeniably.

And yet the Fed is still waiting. Not because it is confident. Not because it has control. But because waiting is all it can do. The moment policy bends, the mask of discipline falls away. So they delay, they posture, they insist on “data dependence” while the foundations of the system creak under the weight of debt, deficits, and disorder.

The Bond Market’s Warning

If you want to know what’s real, stop listening to central bank press conferences. Look instead at the bond market. That’s where the truth leaks first. Long-duration yields have grown restless. Volatility is back. Pension funds, sovereigns, banks, the entire structure of modern finance leans on those bonds. If they wobble, everything wobbles.

And they are beginning to wobble.

For policymakers, this is the nightmare. Inflation they can tolerate. But a disorderly bond unwind? That’s the kind of systemic shock they cannot allow. Which is why, despite the performance of resolve, the outcome is already written. When pressure reaches the breaking point, they will print. They will call it “temporary,” “targeted,” “measured.” But make no mistake, it will be stimulus.

Why This Matters for Crypto

This is the part most traders miss. Crypto does not move in a vacuum. It does not simply decide, on its own, when the great bull market begins. It waits for the macro. First liquidity enters credit. Then equities catch the flow. Bitcoin follows, first as a hedge, then as a momentum trade. And finally, the flood reaches the altcoins.

That sequence has played out before, and it will play out again. Which means that no matter how many short-term pumps we see, the full tide has not yet arrived. Until central banks bend, until liquidity truly floods back into the system, crypto is warming up, not breaking out.

This is what I want my community to understand: chill. The impatience, the anxiety, the obsession with every dip and surge, it’s wasted energy. The real shift is macro, and it hasn’t happened yet.

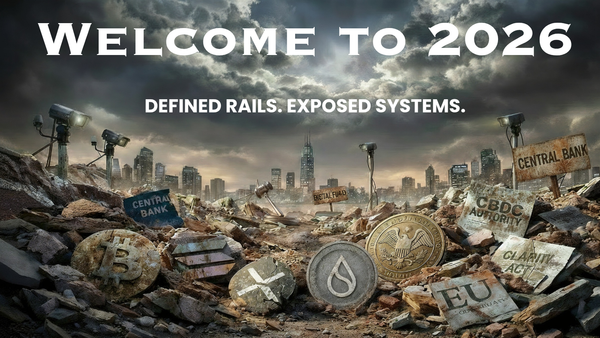

The Coming Split in Crypto

But here’s the twist. When the tide does come, it won’t lift everything equally. Because not all crypto is created equal anymore.

On one side, you have the compliant chains, the ones with freeze functions, clawbacks, blacklists, and committees ready to bend to the will of regulators. These are the polished digital rails the establishment wants to sell as “safe.” They look decentralized on the surface, but under the hood, they’re CBDCs in disguise.

On the other side, you have the trustless assets, immutable code, no middlemen, no admin keys, no CEO to subpoena. Assets that cannot be seized, cannot be blacklisted, cannot be bent to the will of politicians. This is the open ocean, not the controlled stream.

PulseChain sits firmly in this second camp. It’s not a corporate network propped up by PR campaigns. It’s a living, breathing decentralized ecosystem, 52,000+ validators, open to anyone, answerable to no one. That difference will matter when liquidity floods back. Because capital is tribal. It seeks safety, but it also seeks freedom.

The Patience That Pays

So where does that leave us now?

In the waiting. In the space between the promise and the pivot. Markets will pump and dump. Enthusiasm will flare and fade. But until the macro bends, we are not in the main act, we are still in the overture.

And that’s fine. Because those who understand this don’t chase noise. They position themselves quietly. They accumulate. They build conviction. And when the flood finally arrives, they’re not scrambling to get in, they’re already there, standing in the right place, with the right assets.

Conclusion

This isn’t about fear. It’s about recognition. The cycle is clear:

The printer.

The panic.

The pivot.

We are still in the stage of delay. But delay is not denial. The tide always turns. And when it does, the split between controlled crypto and trustless crypto will become obvious to all.

Until then, patience isn’t weakness. It’s power.

~Veritya Thalassa