The Original Protocol

He didn’t keep the family name. He renamed himself after the symbol: Rothschild. It was more than a rebrand. It was a transformation. From man to myth.

The Red Shield. The Original Network. And the Debt Engine That Still Runs the World.

There are patterns you feel before you ever learn their names.

As a child, I remember watching the world move—leaders rising, nations falling, markets crashing like weather systems—and sensing there was something underneath it all. It wasn’t just money. It wasn’t just politics. It was something older. Quieter. Tighter. Something that didn’t need to be seen, because it was already inside the structure.

And for years, I couldn’t name it.

Until I found the story of a coin shop in Frankfurt. A story that wasn’t taught in school. A name that never appeared on timelines. But when I found it, something clicked.

It started with a sign.

Just a red shield. Hanging above a door.

In 1743, in Frankfurt, Germany, a goldsmith opened a shop in the Jewish quarter. His name was Amschel Moses Bauer. He dealt in coins, metals, and careful measurements. But over the door of his modest shop, he hung a bold symbol: a Roman eagle clutching a red shield.

To the locals, it became a landmark. They called the shop Rothschild—German for Red Shield.

Nothing about this seems extraordinary at first. But when you zoom out—when you follow the ripple through time—you realise: that red shield didn’t mark a location. It marked the beginning of a design. And that design would come to shape how the entire world moves today.

When Amschel Bauer’s son took over the business, he didn’t just inherit a shop. He inherited a way of seeing. Amschel Mayer Bauer looked at the small coin trade and understood it wasn’t coins that moved the world — it was trust. Trust in value. Trust in gold. And most dangerously… trust in debt.

He didn’t keep the family name. He renamed himself after the symbol: Rothschild. It was more than a rebrand. It was a transformation. From man to myth. From individual to instrument. He understood something most people still don’t: names are masks. But symbols are doors.

Most lenders of that time operated like any business — small loans to merchants, tradesmen, landowners. But Rothschild saw something else. He saw that the greatest borrowers weren’t men. They were nations. And when a nation borrows, the people become the collateral. Not through consent — but through taxation, obedience, and law.

It hit me like a blade when I realised this. To lend to a man is a transaction. To lend to a king is architecture. You’re not just earning interest. You’re reshaping history.

Amschel Mayer didn’t stop there. He raised five sons — and trained them like pieces in a living strategy. Not as heirs. As operators. And instead of keeping them close, he sent them outward:

Amschel remained in Frankfurt. Salomon was sent to Vienna. Nathan — the most cunning — to London. Carl to Naples. James to Paris.

This wasn’t a family business. This was a network deployment across Europe’s key power hubs. Before the internet. Before the telephone. Before the idea of globalisation had a name. They built their own system. Courier networks. Coded messages. Trusted agents. They were moving intelligence and capital faster than entire governments.

London, 1815. The day everything changed. The Battle of Waterloo ends. Napoleon is defeated. But the news hasn’t reached England yet. Nathan Rothschild receives it first — through the private family network.

He walks into the London stock exchange and starts selling everything. Traders panic. Markets plunge. And then — in the silence that follows — he buys it all back.

Hours later, the official news of victory arrives. Nathan doesn’t just walk away with profit. He walks away with influence over British finance so deep it never truly ended. And from that moment forward, I saw it differently. This wasn’t history. This was the source code of the modern financial system.

It didn’t end with the sons. There was no collapse. No scandal. No reckoning. Because power like that doesn’t exit the stage. It just changes costume. The Rothschilds didn’t need to keep the spotlight. They’d already built the theatre. And the actors that came after? They kept using the script — even if they never knew who wrote it. You see, when a design is perfect enough, it becomes invisible. It folds into law. Into custom. Into the way things are. And the Red Shield? It was never just a family. It was a formula.

I once walked through old parts of London and Paris, following the ghosts. You don’t need a guidebook. You just need to look up. At the shields etched into buildings. At the eagles perched above doorways. At the crests no one questions anymore. Not decoration. Not heritage. Markers. Traces of an older architecture, laid out like ley lines across capitals — not for tourists, but for those who knew where decisions were really made.

Every nation has its flags. But beneath them, there are symbols older than any constitution. And they all seem to point to the same silence.

I used to think history was a conflict between countries. But now I see it as a dance between debtors and lenders. Empires rise and fall — but the underwriters stay. Kings were replaced by parliaments. Gold by paper. Paper by code. But behind each transition, there’s always that same shape: a node. A family. A shield. Not visible, but always there. Not voting, but always deciding. And once I saw that… I couldn’t unsee it.

Every war. Every revolution. Every crash. There’s the story we’re told. And then there’s the silent movement of capital underneath it. Money doesn’t just react to history. It writes it. And the families who understood that early on… they didn’t need armies. They just needed patience. Because when you finance both sides, and hold the note on the aftermath, you don’t need to predict the future. You create it.

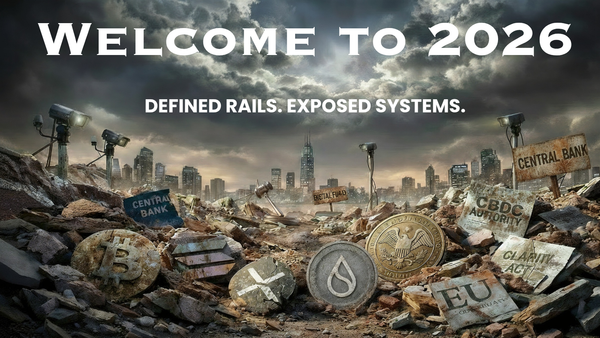

They told us wars are about borders. They told us inflation just happens. They told us digital IDs, collapsing currencies, and restructured debt are all just progress. But what if they’re not?

What if what we’re seeing isn’t chaos at all — but a sequence? What if the fall of the middle class, the engineered scarcity, the quiet dissolving of cash — what if the cost-of-living crisis isn’t a glitch in the system… but the system itself working as designed?

And what if the people designing it — aren’t elected, don’t campaign, and have no flag but liquidity?

We’re being nudged. Pulled. Repositioned. Out of sovereignty. Out of privacy. Out of wealth we can touch and into something else entirely. And we’re meant to thank them for it.

But I’m not here for that story.

Because for the first time in our lifetime, there’s a structure outside their architecture. A system with no middlemen, no levers of control, no black doors behind the interface. A marketplace without gatekeepers. A Wall Street without Wall Street. Code we can see. Yields we control. Communities that build instead of beg.

PulseChain isn’t just another chain. From what I can see — it’s our only hope.

And that’s why I’m here. Not because I want to fight the old world… but because I finally saw how it was built. And I want nothing to do with it.

— Veritya