The Real Crypto Revolution: What They Don’t Want You to Understand

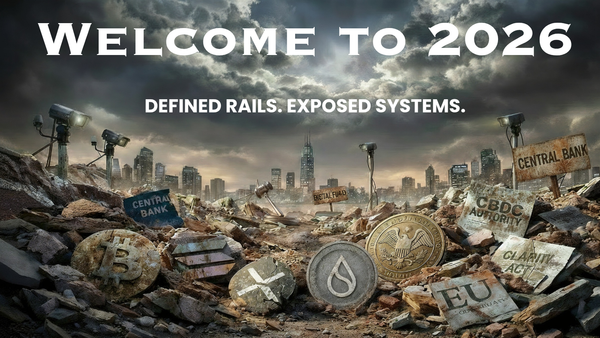

While the public chases memes and hype cycles, the real infrastructure is being assembled beneath them.

Crypto was never meant to become what it is today. It began as a revolt against a collapsing world, a lifeline carved out of chaos, yet over the years it was quietly bent back toward the very forces it tried to escape. What follows is the part they prefer you never look at too closely.

Please watch and listen carefully. Visit the Trustless Index here.

In 2008 the financial system cracked open. Banks imploded. Governments scrambled. Trust evaporated. The world felt rigged in a way people could finally see clearly. And then, almost silently, a document appeared online. Bitcoin. A peer to peer electronic cash system. It read like a manifesto disguised as a whitepaper. It wasn’t promising riches or status or hype. It offered something far more subversive. A way to remove the weakest link in the monetary system. Humans.

Satoshi’s idea was deceptively simple. If you remove the need to trust a person, you remove the leverage that corrupts the system. Let code take the role humans keep failing at. Let open, transparent, verifiable rules replace gatekeepers. Let people transact without asking anyone for permission.

Bitcoin was never built as a tech toy or a speculative carnival. It was a rebellion. A quiet one, but a rebellion nonetheless.

Long before Bitcoin there were the cypherpunks. The ones who saw the digital age coming long before the rest of the world felt its shadow. They understood that the convenience of technology would not arrive alone. It would bring surveillance. Control. Institutions with perfect visibility into your life. Their answer was encryption and sovereignty. Their warning was simple. If value is going to live on the internet, it must be trustless.

Trustless means no assumptions. No blind faith. No dependence on an authority to behave. The system works the same for you as it does for a billionaire or a government. It cannot discriminate because it does not know who you are. That was the beauty. Verification replaced belief. Math replaced hierarchy.

Bitcoin allowed two people anywhere on earth to transact without a bank, a politician or a corporation in between. It was not flashy. It was not fast. But it was pure.

And yet even Bitcoin was not immune to human fingerprints. It has developers. A small group who maintain and shape the protocol. Humans with ideologies, incentives and political pressures. The code has changed many times. Consensus rules have evolved. And the uncomfortable truth is this. Bitcoin is not immutable. It is governed by human coordination. And where humans gather, influence gathers with them.

When Satoshi vanished the protocol didn’t freeze. It drifted under new hands. The original vision of peer to peer cash gave way to a new narrative. Digital gold. A slow, heavy asset meant to sit still rather than move freely. The dream softened to fit the expectations of institutions.

And then the VCs arrived.

Venture capital does not enter without reshaping everything it touches. VCs want control. Admin keys. Influence over development. Token allocations. Backdoors dressed up as “features.” Crypto projects slowly bent toward profit extraction rather than sovereignty. Centralized exchanges emerged as on-ramps. Convenient. Familiar. And perfectly capable of recreating the very dependency crypto was supposed to eliminate.

Crypto returned to middlemen. Only this time the bankers wore hoodies.

Today the industry runs on bait-and-switch architecture. Newcomers are funneled into VC chains and custodial platforms, believing they’re stepping into freedom when they’re actually entering a digital holding pen. Most of these networks have pause buttons, blacklists, transaction reversals and surveillance baked into their foundations. The same architecture that underpins what comes next.

Central Bank Digital Currencies.

CBDCs are the endpoint of programmable money. Every transaction tracked. Every purchase visible. Every wallet controllable. Money becomes an instrument of conditional access rather than an expression of sovereignty. The Trojan horse of our generation. A system that looks like crypto, feels like crypto, but is shaped entirely for surveillance.

While the public chases memes and hype cycles, the real infrastructure is being assembled beneath them.

And this is the context in which Richard Heart stands out. One of the few builders who refused to bend toward compliance culture. He saw the creeping introduction of admin authority. The freezing functions. The surveillance hooks. And he walked in the opposite direction.

He built systems where the creator cannot return. Code that once deployed cannot be altered. Contracts with burned keys. Networks without an overseer. Immutable means final. It means no edits. No updates. No switch to flip when a regulator calls. The rules apply equally to everyone, including the founder.

Self-custody sits at the heart of all of this. Your wallet is not actually a wallet. It is a viewer into a global spreadsheet. Your keys prove that the entries belong to you. If you leave your funds on a centralized exchange you own nothing but an IOU. If they freeze your account, lose liquidity or collapse, you lose everything. Custody is not a technical preference. It is a philosophical direction.

Layer 1 blockchains are the foundations of entire ecosystems. Bitcoin and Ethereum are Layer 1s. PulseChain is a new Layer 1 built to revive the ethos that was slipping away. Faster. Cheaper. Accessible. And most importantly, aligned with the principle that decentralization is not optional. It is the entire point.

When the SEC went after Richard Heart they expected to find a company, a founder with admin rights, a lever to pull. Instead they found immutability. They found code with no owner. They found no mechanism to weaponize. And in the end, they lost. It was a victory for DeFi that should have echoed across the industry, but it threatened too many narratives for the media to celebrate.

DeFi at its core is simple. Financial tools built from pure code rather than institutions. No banks. No middlemen. No censorship. Systems that execute exactly as written, not as interpreted.

And that brings us to the moment we stand in now.

If you believe in sovereignty If you believe in systems that cannot be bent, bribed or rewritten If you believe the future must be built on verifiable truth rather than permission, then you already know where the real road leads. Welcome to PulseChain. Where the original spirit of crypto still breathes. Where the revolt continues without asking for approval.