The SEC Blinked First — But Richard Heart Was Never Playing Their Game

He built immutable, transparent systems. Yield through time. Not loopholes. Ownership without gatekeepers. Participation without permission. Call it what you will — but it's now clear he built correctly.

For years, they dismissed him. For years, they ridiculed HEX. For years, they said the SEC would be the end.

And yet, here we are.

The SEC has now quietly dropped or lost nearly every major crypto case it pursued over the last two years — Coinbase, ConsenSys, Kraken, even Binance. Legal tides are shifting.

But Richard Heart? He never needed to play catch-up.

HEX, PulseChain, and PulseX weren’t just resilient. They were untouchable. Because they were built to be — with no middlemen, no admin keys, no promises — just code.

And in response to Richard Heart’s latest post revealing the SEC commissioners’ voting records, it’s become even clearer:

He was always several moves ahead.

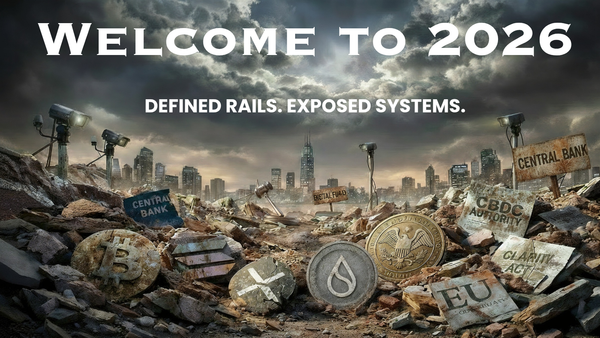

The Legal Retreat That No One’s Talking About

The SEC once launched a full-scale attack against the crypto industry. Headlines were filled with threats. Fear ran rampant.

Then came the dismissals.

In early 2025, a federal judge threw out the case against Richard Heart and his projects. Why? Because the SEC never had jurisdiction. The code didn’t target U.S. users. There were no custodians. No intermediaries. No backdoors.

Compare that with centralized players like Coinbase and Binance who negotiated, settled, or conceded territory.

HEX didn’t. PulseChain didn’t. PulseX didn’t.

They didn’t have to.

Because they were architected to survive.

A System Designed to Withstand Attack

Richard Heart didn’t build to impress regulators.

He didn’t build to attract venture capital.

He didn’t build products that relied on personalities or hidden leverage.

He built immutable, transparent systems.

Yield through time. Not loopholes.

Ownership without gatekeepers.

Participation without permission.

Call it what you will — but it's now clear he built correctly.

PulseChain: Where the Real Innovation Is Now Happening

While the headlines talk about ETFs and TradFi integration, real infrastructure is quietly being built elsewhere.

PulseChain is becoming the new financial district of DeFi.

It’s not noise — it’s functionality.

Projects like LibertySwap are paving the way. A privacy-first, cross-chain protocol that requires no wallet connection, no front-running, and no compromise. It's the kind of thing that should have been done years ago — and now it is, on PulseChain.

This isn’t about chasing trends. It’s about returning to purpose.

The Verdict Is Clear

Richard Heart didn’t dodge the SEC. He rendered them irrelevant.

While others negotiated settlements, his creations stood alone — and stood strong.

The doubters have run out of ammo.

No VCs. No sellouts. No centralized chokepoints.

Just verifiable truth, written into code.

So where do we go from here?

The answer is obvious.

PulseChain.

It’s not just surviving — it’s thriving.

Builders are deploying.

DeFi is evolving.

And the playbook has changed.

You don’t need to be early to hype.

You need to be early to what’s real.

And what's real is happening on PulseChain.

Wall Street never owned crypto. But a new kind of financial district is forming — one built on transparency, sovereignty, and code.

And its name is PulseChain.

Veritya Thalassa