What is PulseChain?

Welcome to PulseChain

A next generation Layer 1 blockchain — built not to imitate Ethereum, but to outdo it.

PulseChain is faster, cheaper, and greener than Ethereum, and yet it's fully compatible with the Ethereum ecosystem. Why? Because it didn’t just copy Ethereum’s code — it copied its entire state. Every wallet. Every token. Every smart contract. Everything.

This bold move — called a system state fork — had never been done before. While other chains start from zero, PulseChain started from everywhere. The moment it launched, it became the home of the world’s largest airdrop, instantly duplicating every ERC-20 token, NFT, and ETH balance from Ethereum onto a new, improved chain. If you had assets on Ethereum, you now have free copies on PulseChain — same wallet, same keys, no middlemen, no signup.

It was a historic moment in blockchain.

This wasn’t a marketing gimmick. It was a statement. A challenge to the status quo. And it worked.

PulseChain now powers an entire ecosystem of DeFi protocols, meme coins, stablecoins, yield projects, and real community. It’s not some empty ghost chain. It’s alive — and it’s growing.

At the center of it all is Richard Heart, creator of HEX and the driving force behind PulseChain. He saw what Ethereum had become — congested, expensive, and drifting toward centralization — and decided to build a better version. Not from scratch, but by forking Ethereum’s entire reality and fixing what was broken.

This is what sets PulseChain apart. It’s not just another chain. It’s a financial lifeboat. A reboot of crypto’s founding principles: speed, sovereignty, and trustless code.

Welcome to the chain that changes everything.

For Newcomers: Key Terms Decoded ➥

Layer 1: The foundational blockchain that everything else is built on.

DEX (Decentralized Exchange): A trading platform that runs on code, not people.

Validator: A computer that confirms transactions and keeps the network secure.

Burn: Permanently destroying tokens so they can never be used again. This reduces the total supply and makes each remaining token more scarce. A simple burn removes tokens that already exist in the system — often from transaction fees or mint limits.

Buy and Burn: A more powerful version of burning. First, the protocol buys its own tokens from the open market, creating buying pressure that can lift the price. Then, those tokens are burned forever. This is what PulseX does — and it’s one of the only DEXs in crypto with this mechanism built in. It creates ongoing demand while reducing supply, benefiting long-term holders.

Staking: Locking up tokens to earn rewards.

Airdrop: Free tokens sent to users, often to encourage migration or adoption.

Liquidity: How easy it is to buy/sell something without crashing the price.

Smart Contract: A self-executing piece of code on the blockchain.

Delegation: Giving your tokens to someone else to act on your behalf, usually to help validate blocks and earn rewards.

Kill Switch / Admin Key: A hidden function that lets someone freeze or reverse transactions — something PulseChain doesn’t have.

The Key Features That Set PulseChain Apart

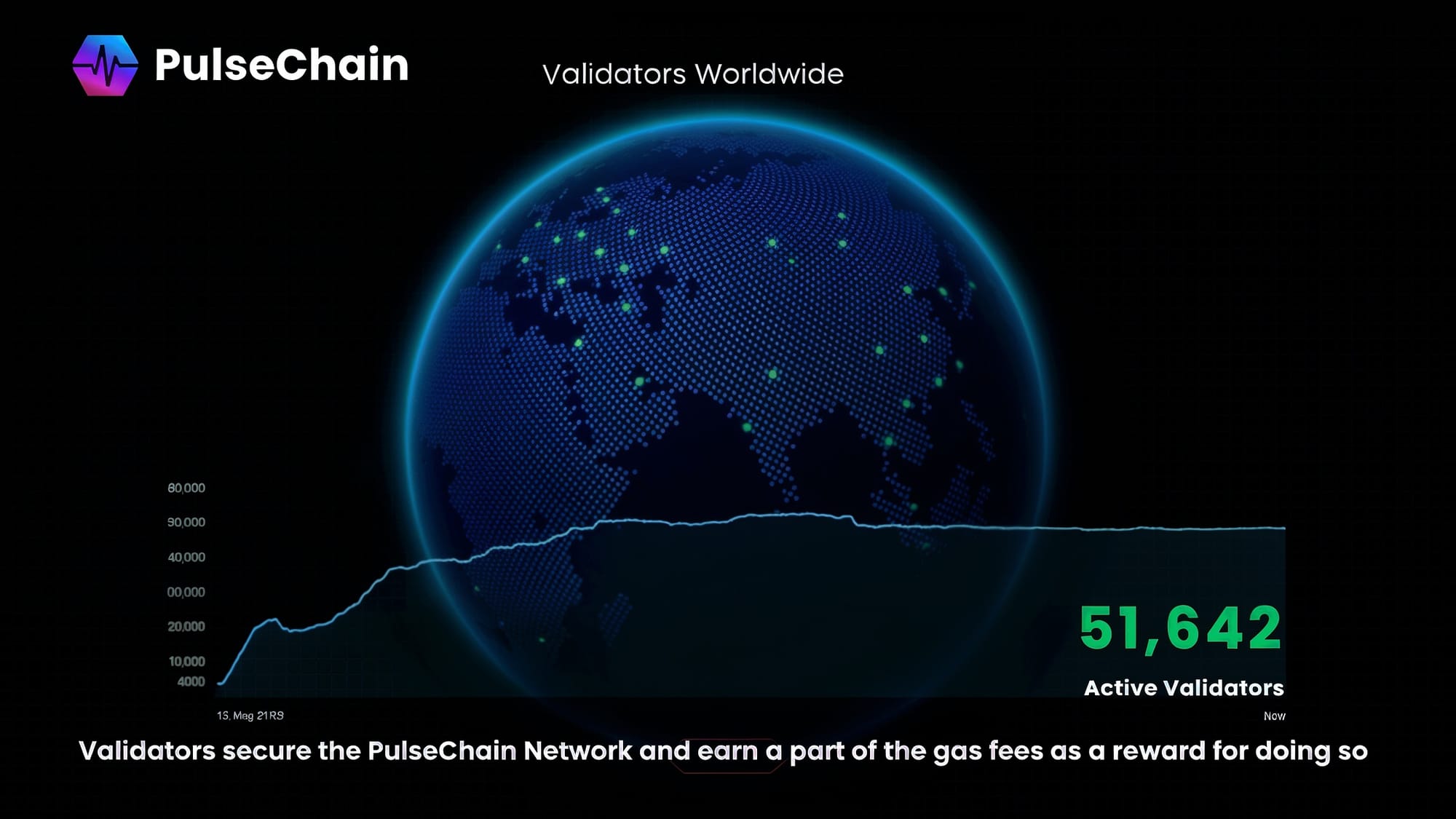

1. Massive Validator Network

PulseChain is secured by nearly 50,000 validators — and it hasn’t even been through a full bull run yet. Compare that to blockchains that have been live for many years with fewer validators, and you start to understand the scale of decentralization being achieved this early.

Ethereum, launched in 2015, now has over 1 million validators, thanks to a major shift to Proof-of-Stake and innovations like liquid staking. However, much of this stake is concentrated in large custodial services like Coinbase and Lido.

PulseChain’s validator set, though smaller, is already impressively large for a brand-new chain and highly distributed by design — a strong signal of trust in the network’s future.

Compare this to other chains like Solana and SUI, which are fast but come with serious trade-offs. Solana doesn’t use typical Delegated Proof-of-Stake (DPoS), but it does allow users to delegate their coins to a small number of high-powered validators. These validators run on powerful machines in large data centers — meaning a handful of companies control the infrastructure. This has caused Solana to go offline multiple times.

Solana’s system combines Proof-of-History (a way of timestamping) with Proof-of-Stake, but behind the scenes, a small group of validators makes most decisions. That’s not truly decentralized.

SUI is even more controlled. It uses a system like DPoS where a few trusted parties run the chain, and it has already shown the ability to pause or reverse transactions — meaning if the people in charge don’t like what’s happening, they can freeze your funds. That’s exactly what crypto was supposed to prevent.

This is becoming a dangerous trend — stablecoins and other tokens now often include "kill switches" or backdoors where developers or institutions can freeze, change, or reverse what happens on-chain. PulseChain stands against this. It has no admin keys, no reversals, and no censorship. Just code that runs exactly as written.

2. Ultra-Efficient Consensus

PulseChain uses a modified Proof-of-Stake system (based on Ethereum 2.0) — but faster. Blocks are confirmed in seconds, not minutes. This means:

Near-instant finality for transactions

Smooth user experience

No more gas wars

PulseX: The Heart of the On-Chain Economy

PulseX is PulseChain’s main decentralized exchange (DEX). You can think of it like the stock exchange of this new blockchain economy. But unlike a traditional exchange — PulseX isn’t owned by anyone. It’s code, not a company.

What makes PulseX special?

Buy-and-Burn Mechanism

Every time people trade on PulseX, a portion of the trading fee is used to buy PLSX (the native token of the exchange) — and then burn it forever. This:

Reduces supply

Increases scarcity

Drives price over time

So far, over 7.3% of the entire PulseX supply has already been burned.

In traditional finance, Wall Street hoards profits. On PulseX, the protocol itself burns its own token to benefit the holders. That’s what we mean by “value loops.”

HEX, PulseChain, PulseX: A Triad of Trustless Yield

Here’s where it gets elegant. HEX is the time-locked yield protocol. You stake it, you earn trustless yield. PulseChain is the chain it runs on. PulseX is where it trades. Together, they form a feedback loop that keeps liquidity, utility, and value circulating through the system.

And it’s all done through smart contracts — immutable code. No CEO, no building, no one to beg. Just math and time.

This is what separates PulseChain from everything else: it’s not a collection of projects — it’s an interlocked economy.

Liquidity Bonding: The Invisible Glue

When people say PulseChain has “deep liquidity,” what they mean is: tokens in this ecosystem aren’t just floating in isolation. They’re bonded together, especially with PLS and PLSX.

This is why:

▫️Prices don’t crash as easily

▫️Value stays within the ecosystem

▫️Trading pairs remain stable

Liquidity providers on PulseX often pair their assets with PLS or PLSX, making them sticky to the chain. That’s how PulseChain keeps value bonded — and why it’s so hard to drain or exploit.

Think of it like gravity: the more liquidity that bonds to PLS or PLSX, the stronger the entire system becomes.

Deflation: The Secret Sauce

Most blockchains inflate their tokens endlessly (Ethereum included — although that’s changing). PulseChain flips the script:

PLS was fully minted at launch

Every transaction burns a tiny bit of PLS

The more you use it, the more scarce it becomes

Scarcity, not inflation, is the model. Just like Bitcoin — but with actual utility.

PulseX does the same with its buy-and-burn loop. Every trade strengthens the deflation. These are self-reinforcing mechanisms that benefit the long-term holders — not the insiders.

Now — to be fair — Ethereum’s 2021 upgrade (EIP-1559) introduced a burn mechanism that removes a portion of ETH fees from circulation. Combined with the Merge in 2022, which reduced ETH issuance by ~90%, Ethereum can become temporarily deflationary during times of high activity. But that’s the key: only during spikes in usage.

PulseChain, on the other hand, is deflationary by design, through both validator burns and PulseX trading loops. You don’t have to hope for congestion — the burn is constant.

Real DeFi: No Middlemen, No CEOs, No Rugpulls

Richard Heart didn’t build products with admin keys or hidden code. HEX, PulseChain, and PulseX are all immutable — the smart contract code is locked. No one can change it, pause it, or reverse it.

This means:

▫️No centralized control

▫️No shutdown risk

▫️No governance votes to dilute you

▫️This is the real DeFi dream — and it's live.

The Bigger Picture: Wall Street on the Blockchain

PulseChain is not just a chain. It’s an entire economy.

With time-based yield (HEX)

With a hyper-efficient DEX (PulseX)

With bonded liquidity and deflation

With nearly 50,000 validators and zero middlemen — in under two years

It’s built for early positioning, delayed gratification, and truth through code. The message is simple.

“Get in early. Lock it in. Let time do the work.”

If Ethereum is a congested city, PulseChain is the open frontier — and it’s still early.

Final Thoughts

PulseChain is the greatest opportunity the crypto world has seen since Ethereum — only this time, without the gatekeepers, the VCs, or the inflated promises.

It’s code you can trust. Yield you can verify. And value you can position into — before the rest of the world catches on.

Welcome to PulseChain.

This is not just another blockchain.

This is a movement.

— The PulseChain Nexus